Mercado do Transporte Marítimo de Carga Contentorizada

(2019/2020/2021/2022/2023)

What happened during the supply chain crisis?

A model explanation in three phases:

1) First, in 2020 (Contração Curva Oferta) - The supply curve moved to the left. The supply capacity decreased. There was little spare capacity in the market as the covid pandemic caught the container shipping industry at a moment of a historically low order book. Container ships spent about 20 per cent longer in port than pre-covid, exacerbated by supply chain blockages on land caused by covid restrictions. Schedule reliability plummeted, and available capacity was reduced by ships anchoring, waiting to be able to enter port;2) Second, mostly in 2021 (Aumento da Procura) - The demand curve moved to the right. With economic stimulus packages, demand increased on key routes, notably out of China. Consumers reduced spending on services (restaurants, travel, movies) and instead spent more on goods purchases (home trainers, IT gadgets, garden equipment);

3) Third, since early 2022 (ajustamento da Procura/Oferta aos níveis pré-Covid) - Demand and supply are moving back towards pre-covid levels. Consumers are leaving their homes and spend more of their money on services. On the supply-side, ports and transport service providers have improved operations, newly ordered ships are starting to enter the market, and port congestion is resolving. Spot freight rates on 9 December 2022 are still 18% higher than the pre-covid average, but the trend is clearly downwards.

Análise de Jan Hoffmann (Head, Trade Logistics at UNCTAD)

Liner Shipping Ahead: Gloomy Outlook for 2023

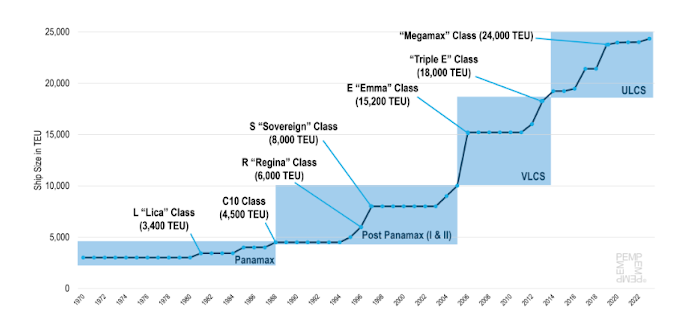

While carriers are still publishing record profits for their liner shipping activities in Q3, the outlook for the Asia – Europe trade is increasingly gloomy as spot ocean freight rates are still nosediving and 69 more Megamax ships (23,000+ teu capacity) are under construction.

Liner shipping sector experiences acute shortage of capacity for the first time ever in 2021 and 2022 - "As a consequence, spot ocean freight rates increased to sky-high levels. This evolution was unseen in the liner shipping industry but is quite common in bulk markets where the cargo-demand/ship-supply-ratio can trigger dramatic rate changes".

The general expectation that this bullish liner market was to normalize gradually in the course of this year has proven to be unrealistic. Cargo volumes have dropped substantially since August, which accelerated the level of rate declines

Several carriers predicted this market correction but were confident that rate levels would not return to pre-COVID levels. Spot ocean freight rates between Shanghai and North Europe have actually fallen from a high of $15,594/feu in early January 2022.

1) First, in 2020 (Contração Curva Oferta) - The supply curve moved to the left. The supply capacity decreased. There was little spare capacity in the market as the covid pandemic caught the container shipping industry at a moment of a historically low order book. Container ships spent about 20 per cent longer in port than pre-covid, exacerbated by supply chain blockages on land caused by covid restrictions. Schedule reliability plummeted, and available capacity was reduced by ships anchoring, waiting to be able to enter port;

0 Comentários